The Story ⚡

This post summarizes the report of the Nigerian box office performance for 2022. It also juxtaposes the year with 2021 to notice growth. Read on!

Tell me more

In the 2022 box office yearbook compiled by FilmOne Entertainment, endorsed by the Cinema Exhibitors Association of Nigeria, and sponsored by Afreximbank, we observe the performance trend of Nollywood at the Nigerian box office and draw out certain germane indicators to the development, and maybe stagnancy, of the industry.

Though the book gives an account of several things about the industry in comparison with Hollywood, here are seven major things worth talking about.

1. Increase in total GBO

Since 2020, a significant increase in total GBO has happened. From the N2.1 billion in 2022, the figure was pushed to N5 billion in 2021, and from that, it rose to N6.9 million in 2022. This is quite impressive.

There is also an increase in the number of titles released. In three consecutive years, there has been an increase in the total number of titles released. In 2020, a total of 132 titles were released. In 2021, 181 titles were released. By 2022, this number had risen to 215.

Of all the titles, Nollywood titles take a larger percentage. This accentuates Nollywood as the second-largest film-producing country in the world after Bollywood.

2. Drop in Nollywood market share

While the report records an increase for Nollywood in different aspects like the number of cinema screens and total number of titles released, the market share for Nollywood has dropped. Comparing 2022 with 2020 and 2021, a constant decrease will be observed. In 2020, Nollywood recorded 56% box office titles. This is against Hollywood which is 43%. In 2021, Nollywood experienced a fall. While it had 45% of titles, Hollywood had 55%. This drop for Nollywood and rise for Hollywood will still continue until 2022. That year, Nollywood had a poor representation of 30% against Hollywood which had 70%.

In 2020, there was a spike from the preceding years which were marked by regular drops. In 2017, 2018, and 2019, Nollywood had 33%, 28%, and 26% respectively. This record changed in 2020 when the rise was experienced. This was even at a time when the world was coming out of the COVID-19 pandemic and one will think that a fall will be witnessed.

The box office market share does not even have to do with the increase in Nollywood releases against Hollywood. In 2021, out of the total number of releases, 57% were Nollywood titles and in 2022, Nollywood titles made 68% of the total number of titles released. This, however, was disproportionate to the market share.

A close margin between Disney Studio’s GBO and all Nollywood Studios is also observed. Despite the fact that Disney is just a single studio while there are several studios in Nollywood, the former’s performance poses a formidable force against Nollywood. In the report, Disney stands alone as a single studio. It is not categorized under the umbrella of Hollywood with Warner Bros, Paramount, Universal, and other studios from the US. However, in spite of the threat that Disney posed, Nollywood titles grossed more when compared with individual Hollywood studios.

With 32% of the cut going to Nollywood, the industry grossed N2.23 billion in 2022. Conversely, Disney, with 30%, made N2.11 billion. Titles like Thor: Love and Thunder, Dr. Strange in the Multiverse of Madness, and Black Panther: Wakanda Forever contributed a great deal to the performance of the studio. Other Hollywood studios include Warner Bros., Sony, Universal, and Paramount, which made N526.71 million (8%), N1.12 billion (16%), N431.13 million (6%), and N343.82 million (5%) respectively.

At this ratio, it is evident that the local audience is very much interested in local content.

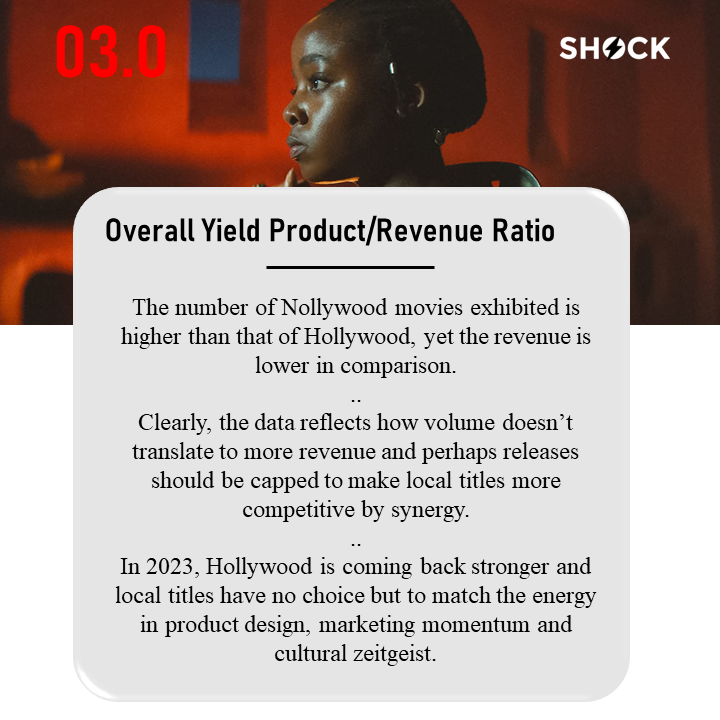

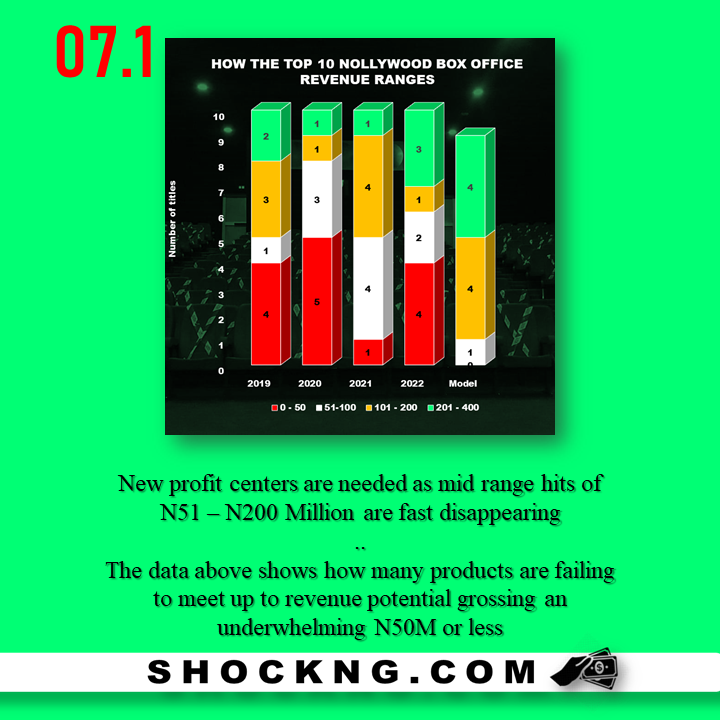

3. Nollywood yield ratio is low

In 2021, the number of Nollywood titles that were released were more than Holly. With a total of 181 titles released, 57% were Nollywood titles while 43% were Hollywood. But despite this margin, Nollywood raked in 45% of the total GBO while Hollywood took the remaining 55%.

Number of Titles Released — 181

Nollywood vs. Hollywood (Releases) — 57% | 43%

Nollywood vs Hollywood (Box Office Earning) — 45% | 55%

As earlier mentioned, the total number of titles released in 2022 was 215, and out of this number, 68% were Nollywood titles while the remaining 32% were Hollywood titles. With this amount of Nollywood productions, which is more than double of Hollywood releases, one would think that Nollywood will also earn about double the total GBO. This sadly is not the case as things turn around and Hollywood made more than double what Nollywood boxed.

Number of Titles Released — 215

Nollywood vs. Hollywood (Releases) — 68% | 32%

Nollywood vs Hollywood (Box Office Earning) — 30% | 70%

This record is not good for Nollywood because it only shows that though the industry is a large-producing one it does not convert much of its products. But another way to look at it is that the industry is a local one competing with an international industry.

4. Drop in the total number of admissions

Even though there is a rise in the total GBO, a fall is seen in the total number of admissions in 2022 as compared with 2021. While 2021 recorded 3,417,214 admissions, 2022 recorded 3,190,249. How is this possible?

With the total GBO disproportionate to the number of admissions, one will begin to look for the possible cause of this. But for one, the increase in the average ticket price is responsible for this. In 2021, the average price of a ticket was N1,450 ($3.49) while in 2022 it had increased to N2,177 ($3.62).

Many reasons might have contributed to the fall in the number of admissions but the economic instability of the country also has a hand in this.

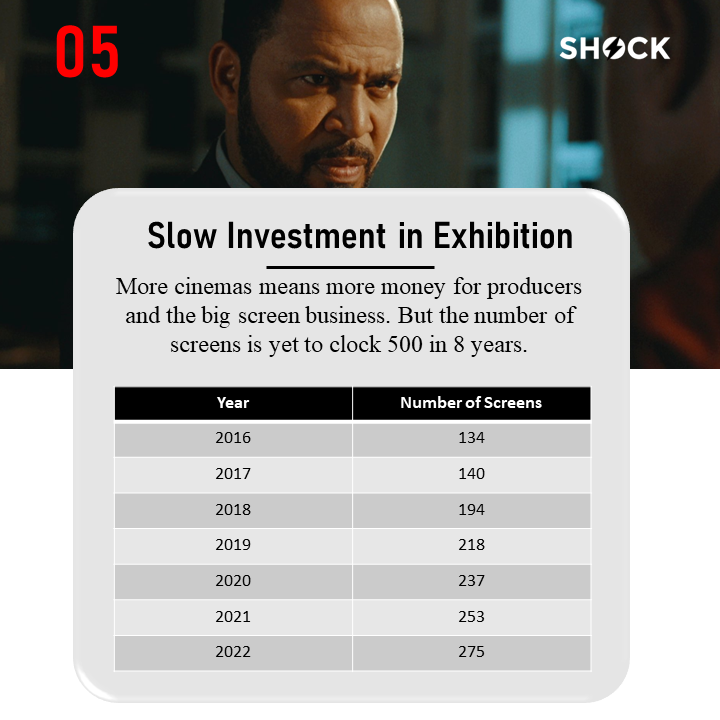

5. Terrible number of cinema screens

Over the years, since the renaissance of cinema culture in Nigeria, the number of cinema screens has always increased, and never has a decrease been witnessed. From 134 in 2016, it rose to 140 in 2017. From that, it rose to 194, 218, 237, 253, and 275 in 2018, 2019, 2020, 2021, and 2022 respectively. But despite the steady rise, the number of cinema screens in Nigeria is still discouraging. In a country of over 200 million people, 275 cinema screens are just too small to cater to this number.

For an increase in the revenue made from the box office, there is a need for investment in the number of cinemas across the country.

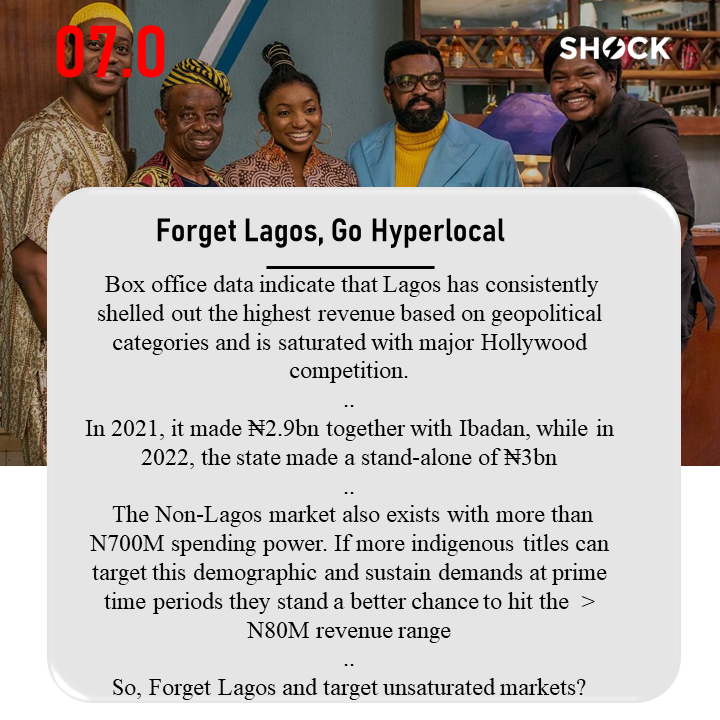

6. Lagos remains the box office hot cake

While there are six geopolitical zones in the country, Lagos, which is just a state out of the six states in the geopolitical zones, is the highest earner in the entire country. In 2022, the state alone made N3.3 billion. This shows that Lagos is a viable box office market.

7. Top 5 admissions in 2021 and 2022

As witnessed almost every year, December 2021 and 2022 grossed the highest in the two years. While 2021 grossed N1.02 billion, 2022 earned N1.09 billion. For 2021, the second highest-grossing month was January (N495.78 million), which did not make up to half a million. July was the highest-grossing month with N469.25 million. The fourth was April (N394.12 million) while June was the fifth with N389.06 million.

1. December — N1.02 billion

2. January — N495.78 million

3. July — N469.25 million

4. April — N394.12 million

5. June — N389.06 million

For 2022, November was the second highest-grossing month with N803.69 million. The figures for November and December were a build-up from October, the third highest-earning month, which had grossed N703.97 million. May and January are the fourth and fifth months respectively. The former earned N690.52 million while the latter made N607.68 million.

1. December — N1.09 billion

2. November — N803.69 million

3. October — N703.97 million

4. May — N690.52 million

5. January — N607.68 million

Summary

With this, we hope to see a significant improvement in 2023. The big-screen business numbers can be profitable, especially for local titles only with a more synergized corporation with creators and distributors.

Thank you for reading

Shockng.com Covers the Business of Film/TV and the Biggest Creators in Sub-Saharan Africa.

Let’s be Friends on Instagram @shockng