The Story⚡

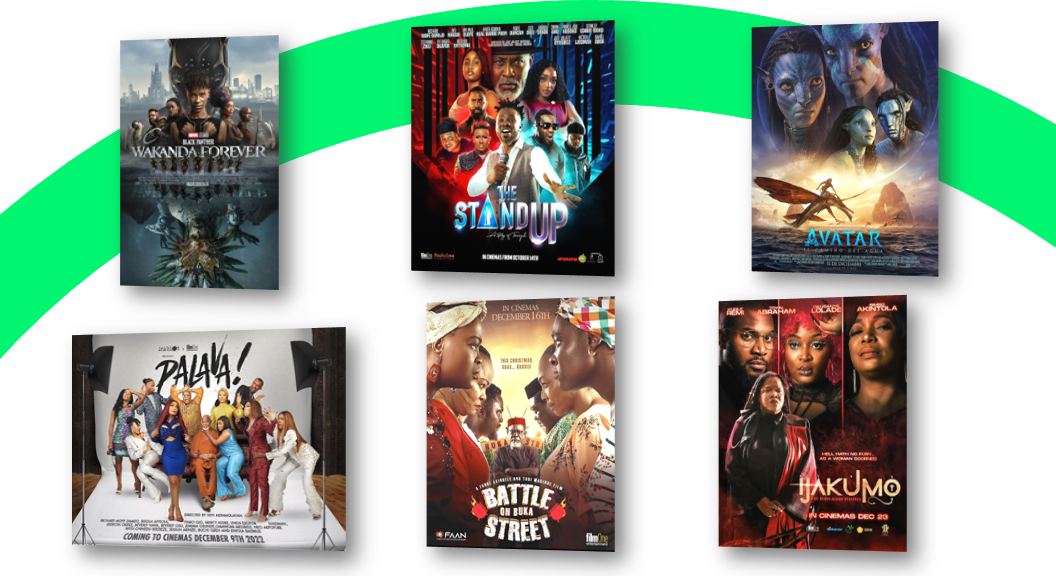

In the weeks ahead of detty december, more than 8 big-budget movies will be squeezed into Nigerian cinemas. From “Avatar 2” to “Ijakunmo” – How does this impact sales and the local producers involved?

Tell Me More

For Moviegoers, Film One has fully stacked box office titles for the period of December.

The exhibitor company has confirmed that no less than 8 new titles will hit the big screen which comprises 4 Nollywood films featuring big box office draws made by local producers.

With just less than 300 screens in the country, more films mean more competition. More competition means more tightly scheduled showtimes. And in the big screen business, most especially in a period where consumer influx is at its highest, every showtime counts.

So how does this scheduling take place in such a way that every product is given a clear pathway to fully capture demand that has been built by anticipation buzz? Also, what’s the plan of FilmOne to make sure optimization is done rightly and money is not left on the table?

If you look at this move as a random person, it doesn’t make any sense.

Why not just release half of these films and ensure they favorable showtimes, makes good money and keep everyone happy?

Yes, that’s a conservative strategy to employ but FilmOne heads towards the opposite direction for 2 valid reasons

Consumer Maxima

More products mean a wide range of consumers can be targeted.

December has proven to be a month that first-time moviegoers can be drawn out of the total addressable market. If the movie options advertised are not vast and exciting, drawing out consumers and converting them to regulars becomes very hard to achieve.

Growth and Profitability for the big screen business are just turning green. Powered by demand for products, the more options are available the more likely growth continues. And with continuous growth, there’s a likely jump in appetite for investment into distribution, which is desperately needed in the industry.

Market Segmentation

This strategy involves segmenting the Nigerian market into two

– a “Lagos market” and a “Non-Lagos market”.

Based on available box office metrics, it is observed that the Lagos consumers are a mix of Hollywood and Nollywood lovers with more preference for Hollywood.

While the non-Lagos market though small, delivers its larger share of ticket sales to Nollywood movies, especially during holidays when movie halls sell out.

With the limited number of cinemas in the country, a total of 68; 35 in Lagos and Ibadan, 33 in the 5 other geopolitical zones, we foresee that one or two films will definitely have to be relegated to the background for other films to shine through.

With a focus on Nollywood, we can deduce that the non-Lagos market will be essential to the performance of the 4 Nollywood films premiering this December. It is also important to note that film distribution company, FilmOne, is co-producing these 4 Nollywood films.

How much of an opening week demand is generated will be very imperative to understand how consumers are accepting of this.

The onus also falls to the cinema manager who makes these key scheduling decisions.

Will it be possible for them to allocate showtime in a way where all films slotted for this December get favourable screen time?

Also, remember that Black Panther 2 is yet to be removed as it is yet to hit its billion naira mark, hence that’s another competition in the mix.

In Summary

For every move, things can go either way.

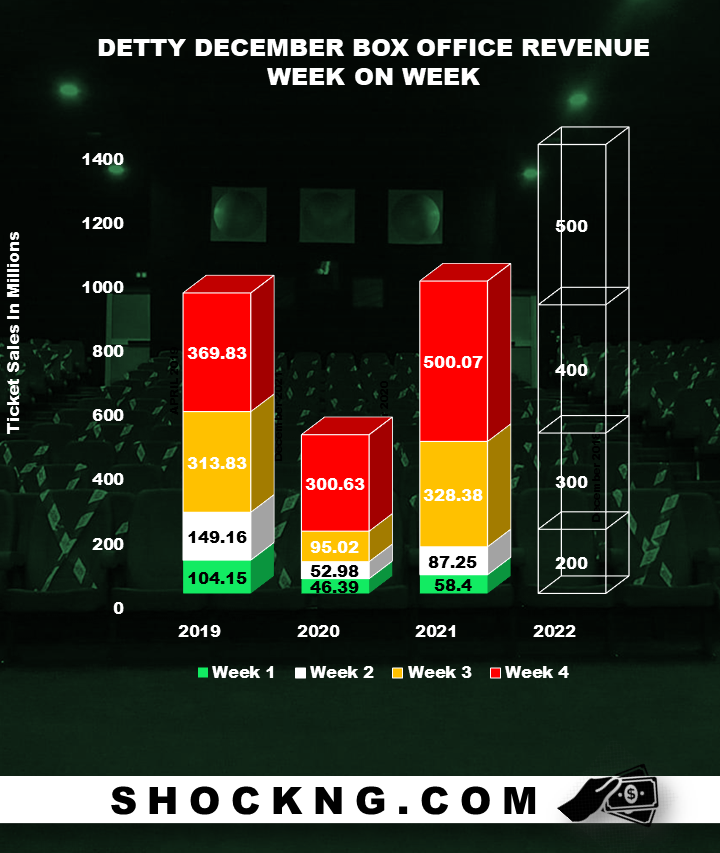

Will there be new records broken this December or rather, the worst-case scenario happens in which the films fall short and stay in the underwhelming N150M range?

The Numbers will tell all. SHOCK is observing.

The Detty December Wave is here.

To understand how movie consumers are spending their hard-earned money, follow our special December box office coverage with new data and insights every day by 1 pm only on SHOCK