The Story⚡

In a recent investor update from the MultiChoice group that owns Showmax, here are 7 insights we have uncovered from the published presentation.

Tell Me More

As of now, Showmax is clearly a streaming service from Africa that can be boldly labelled as a competitor to America’s Netflix and Prime Video. These past years, it has proven as a formidable force in the African market with different titles commissioned and several originals made.

In terms of Metrics, Growth, and Content Slate, here is everything we know so far about the service.

1. Aggressive Spending To Build Showmax

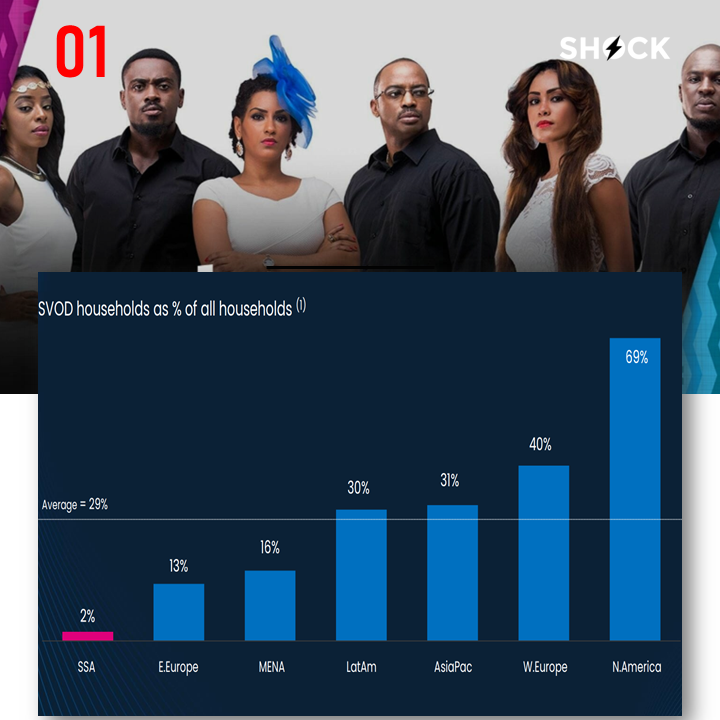

On average, the growth of SVOD in streaming markets across the globe is pegged at 29%. This is to say that a market can be said to have grown when it has crossed the 29% margin. Among the seven markets across the world (sub-Saharan Africa (2%), Eastern Europe (13%), Middle East and North Africa (16%), Latin America (30%), Asian Pacific (31%), Western Europe (40%), and North America (69%)), only the first three among the list are yet to leap into the next margin.

With sub-Saharan Africa being so far from the 29% average SVOD growth rate of just 2%, MultiChoice sees this as an opportunity and plans to rapidly invest via Showmax to the point that it didn’t roll out dividends to shareholders for FY23’.

Change is constant. At some point in the history of the entertainment business, television as a mode of distribution moved to home video. Later it shifted to the cinema. Today, the world of video is gradually shifting to streaming (SVOD). And as opportunities abound in this new model of distribution, traditional media companies are staking their claim in it. MultiChoice is one such company leading in doing this.

2. 50 Markets Covered in Africa

In this report, MultiChoice claims that Showmax has launched in 50 African markets.

The service launched in 2015 is equilaterally enjoying its parent company knowledge market base and using its content library to woo traditional subscribers.

Netflix launched in 2016 and initially started operations in South Africa. Then it stretched the arms of its operations to other parts of Africa in subsequent years. Though launched in 2016, Netflix did not make its first hire until 2019 when it confirmed Dorothy Ghettuba as head of acquisition of African Originals for the service. So far, the streaming giant has focused on three sub-Saharan African markets—Kenya, Nigeria, and South Africa.

Conversely, Prime Video did not begin its local operations in Nigeria until 2021 with title licensing. The platform was later localized in Nigeria in 2022. That year, executives were appointed to head the helms of affairs of the service. The appointed creatives are Ann Williams (Head of Scripted Movies, South Africa), Brendan Gabriel (Senior Unscripted Creative Executive, South Africa), Kemi Lala Akindoju (Senior Movies Creative Executive, Nigeria), and Mike-Steve Adeleye (Senior Scripted Creative Executive, Nigeria). They joined Wangi Mba-Uzoukwu on the Amazon Studios Originals development team.

The streaming platform has focused more on the South African and Nigerian markets.

3. Steady Growth Rate in The Past Years

To know that a business is growing or that its metrics are effective, the growth rate has to be checked. For a business that launched in 2015, it should be expected that it grows steadily after almost a decade. Between 2022 and 2023, the total number of subscribers using the service grew by over 60%. This is a very good metric to measure growth.

The growth does not stop at the year-on-year total subscription rate alone. Within 2022 and 2023, there has also been over 111% year-on-year growth in the rate of paying subscribers. Similarly, there has been over 26% growth in the Compound Annual Growth Rate (CAGR) between March 2019 and March 2023.

According to the document, the service, in the past four years, has expanded its service delivery to other countries in sub-Saharan Africa, aside from South Africa, its home country. The Rest of Africa markets in sub-Saharan Africa have grown by 75% CAGR from 2019 to 2023.

With this steady growth on almost all sides of Showmax, investors can be assured of steady growth.

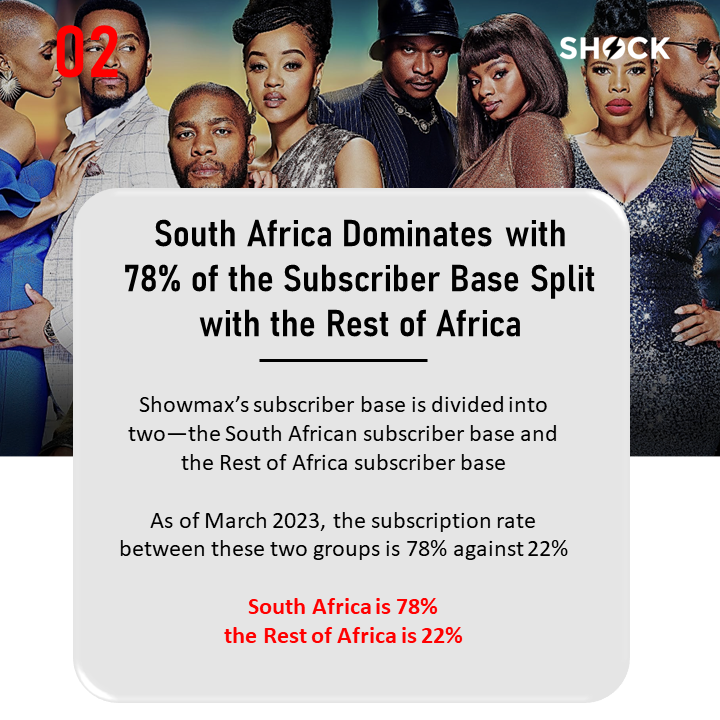

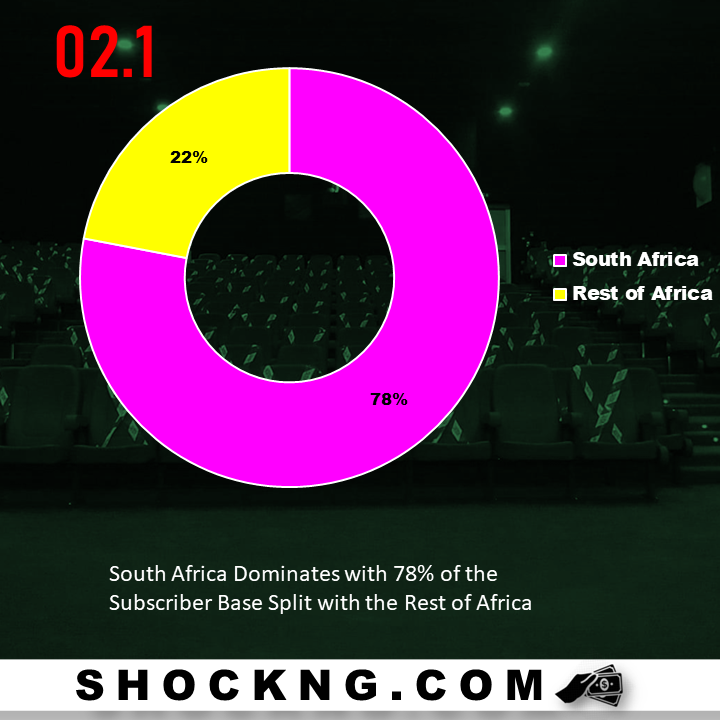

4. South Africa Dominates with 78% of the Subscriber Base Split with the Rest of Africa

Showmax’s subscriber base is divided into two—the South African subscriber base and the Rest of Africa subscriber base. As of March 2023, the subscription rate between these two groups is 78% against 22%. While South Africa is 78%, the Rest of Africa is 22%.

The reason for the high percentage for South Africa is obviously because South Africa is the home country of the service. Notwithstanding this huge growth over the Rest of Africa combined, investors really do not have to worry about non-South African regions not being lucrative. In the previous point, it was mentioned that the service has expanded by 75% and is still expanding. It is getting big, and, hopefully, this will imply investment yield to more subscription growth for the rest of Africa market.

5. Showmax’s Profitability Years Are Still Ahead

While the service has been running since 2015, it is interesting to mention that it is not yet profitable. Showmax’s profitability years are projected to start in 2026, three years from now. However, it is expected that the service will be separated from its mother company, MultiChoice Group, to stand alone as an entity.

At the level of the MultiChoice Group, however, the investment cost is being defrayed through the 30% minority partnership which shall not be paid for. Also, it shall be defrayed through the recovery of investment made on licensed content. This would imply that, while Showmax is yet to start profiting from its investments, its investments in licensed content will start paying off during the profitability seasons. Also, service costs shall be charged to the venture. Showmax is not taking the cost. Rather, the whole MultiChoice Group shall.

6. Showmax + Peacock/NBC Deal Benefits

To broaden its horizon to non-African markets and also offer more content to its existing subscribers, Showmax has partnered with Peacock, a streaming service from NBCUniversal. With the 30% minority partnership, Showmax gets to power Over-The-Top (OTT) media services across US, Europe, and Africa. An OTT media service is a kind of media service that involves the offering of services directly to viewers via the Internet.

What this implies is that cable, broadcast, and satellite television shall be bypassed in getting content across to subscribers.

This partnership Showmax a global scaling. Also, with more global content from Universal, Peacock, Sky, and others, existing African subscribers get to have access to more content. No doubt, Showmax is in for serious business.

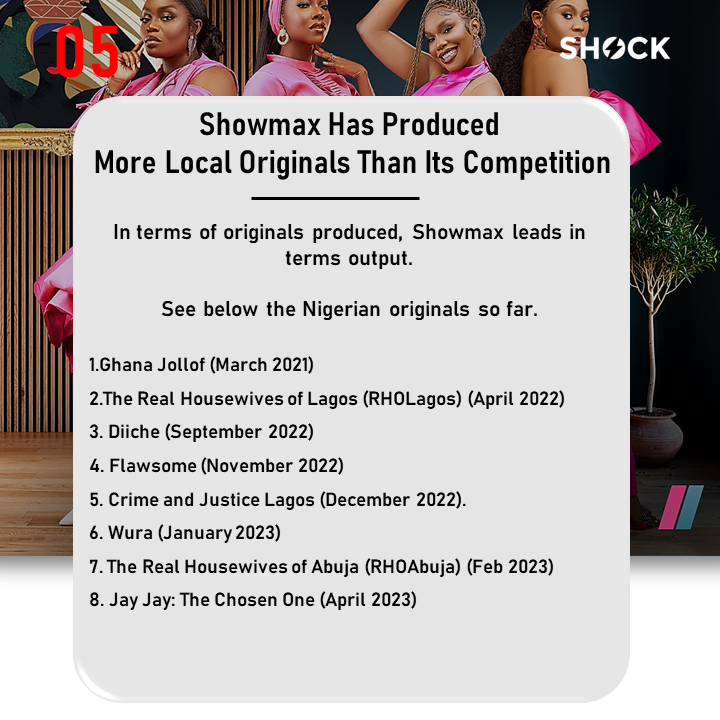

7. Showmax Originals – Pressure Ti Wa!

Over time, Showmax has had to make Original local content to offer a key differentiator. In South Africa and Nigeria, the country has produced many Original content.

In Nigeria, it has invested in the commissioning of Original series.

These include:

1. The Real Housewives of Lagos (RHOLagos) (April 2022)

2. Diiche (September 2022)

3. Flawsome (November 2022)

4. Crime and Justice Lagos (December 2022).

5. Wura (January 2023)

6. The Real Housewives of Abuja (RHOAbuja) (February 2023)

7. Jay Jay: The Chosen One (April 2023)

Summary

Year after year, traditional media subscription keeps declining as movie lovers shift to SVOD. This has threatened MultiChoice which has dominated the African entertainment scene for over a decade now with shows from different countries across the continent. As a proactive company, MultiChoice is aggressively investing in Showmax to prevent what can be called an extinction from the media space. It continues to scale its overall subscriber base, primarily through a strong performance in the Rest of Africa.

With global competition, the streaming wars have become intensified. This is more of a blessing for producers and creators out of Africa as it gives them more opportunities to showcase their talents beyond the shores of their countries. The future, without much doubt, is bright for the African film industry.