The Story⚡

Utica Capital has started a ₦20 billion fund, Nigeria’s first SEC-licensed venture capital fund for Nollywood, to provide funding for film production and help with distribution.

Tell Me More

Nollywood produces over 2,500 movies each year and generates an estimated $6.4 billion in revenue, contributing to Nigeria’s GDP. It reaches more than 35 million viewers daily and supports over four million jobs in the creative sector, which is projected to reach nearly $15 billion by 2025. The industry has grown from $4 billion in 2013 to a forecasted $14.82 billion this year, but faces issues like funding shortages, piracy, infrastructure problems, and distribution challenges. Over 95% of financing comes from personal savings and informal loans, resulting in a ₦200–₦300 billion funding gap.

Utica Capital Limited is a Lagos-based asset management firm licensed by the Securities and Exchange Commission (SEC) under Nigeria’s Investment and Securities Act 2007. The firm focuses on investments using technology and ESG strategies. On October 2, 2025, it launched the ₦20 billion Utica Film Fund, Nigeria’s first SEC-approved venture capital fund for the film sector. This closed-ended fund has a ten-year term and starts with an initial ₦5 billion tranche open for subscriptions, covering pre-production, production, distribution, streaming, infrastructure, merchandising, and licensing.

Target And ROI

The fund offers a regulated option for institutional and high-net-worth investors. Minimum investments are ₦10 million for individuals and ₦100 million for institutions, in Naira or U.S. dollars. It plans to support about 40 projects, with 70% in Nigeria, 20% in Africa, and 10% globally, using independent custodians (First Bank of Nigeria), trustees (STL Trustees and CardinalStone), solicitors (ALP NG & Co), and registrars (CardinalStone Registrars). An Advisory Committee includes Richard Mofe-Damijo, Omoni Oboli, Femi Adebayo, Kachi Offiah, and Sani Muazu to select projects based on storytelling, commercial potential, and market appeal.

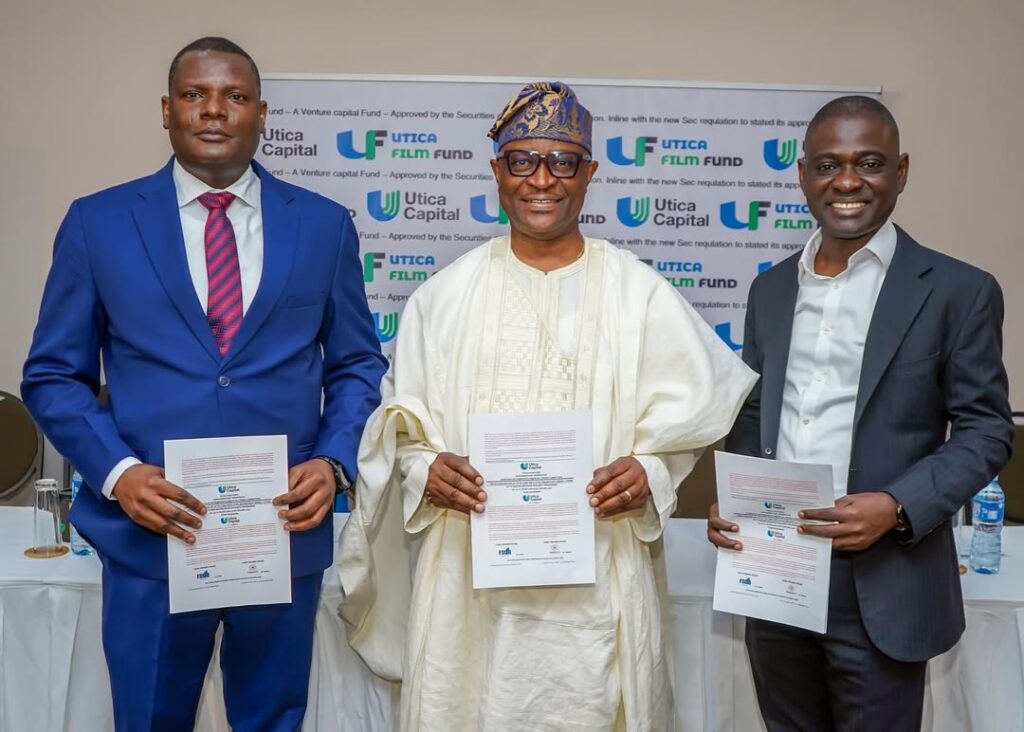

Utica’s Chairman, Dr. Adesegun Akin-Olugbade, and Managing Director Ola Belgore see the fund as supporting Nigeria’s non-oil sectors. At the launch, Akin-Olugbade noted Nollywood as a billion-dollar industry and one of Nigeria’s exports, aiming to reduce reliance on informal financing. Belgore stated the fund targets a 58.2% internal rate of return and a 4.5x multiple on invested capital, with Utica co-investing. SEC’s John Briggs noted the approach but advised on managing conflicts of interest.

The launch included representatives from ALP NG & Co, First Bank of Nigeria, Emerging Africa Capital Advisory, SEC, FSDH Capital, STL Trustees, and CardinalStone Trustees. Others, like former Fund Managers Association President Dr. Ore Sofekun and Dr. SID, described it as a step for Nollywood’s growth.

The fund provides capital, guidance, and mentorship to filmmakers. It plans to issue a call for proposals before the end of the year for projects with financial and market potential. This may support Nollywood’s development and increase its international presence.

In Summary

With Nollywood generating billons in export earnings in the first half of 2024 alone, the A-rated fund (DataPro) offers investors, such as pensions and insurers, a projected 4.5x return over its 10-year term. By financing production, distribution, and infrastructure, it aims to elevate Nigerian films to global standards.

Thanks for Reading.

Shockng.com covers the big creators and players in the African film/TV industry and how they do business.

Let’s be friends on Instagram @Shockafrica