The Story⚡

Netflix Nigeria’s 2025 most-watched list offers crucial insights into audience behavior, content performance, and the evolving relationship between theatrical releases and streaming consumption in Africa’s largest film market.

Tell Me More

Netflix Nigeria’s 2025 viewing data provides the entertainment industry’s clearest snapshot of what Nigerian audiences actually watch when given global choices—and the results validate Nollywood’s commercial viability while exposing strategic opportunities.

For investors, the 80% Nollywood dominance of the top 10 despite Netflix licensing only 24 titles annually proves sustained audience demand isn’t speculation—it’s measurable behavior worth betting on. Ada Omo Daddy’s #2 ranking demonstrates theatrical releases create streaming value, not cannibalize it, validating the Nigerian box office as a launch pad rather than endpoint.

For producers and distributors, this data reveals which genres travel (horror, thrillers, period dramas) and which strategies work (theatrical-first positioning). Lisabi’s sequel underperformance offers lessons on franchise management, while The Forge’s presence signals untapped faith-based market potential.

5 Touch Points From The Data

Here are 5 important data points from the top 30 most viewed movies on Netflix Nigeria in 2025.

Nollywood Dominates the Top 10

Eight of the top 10 titles are Nigerian productions, representing 80% of the upper tier—a remarkable achievement given Netflix’s reduction to licensing just 24 Nollywood titles annually in 2025. This dominance includes The Waiter (#3, 81 days), Devil Is a Liar (#4, 53 days), Thinline (#5, 58 days), Farmer’s Bride (#6, 47 days), The Herd (#7, 40 days), and A Lagos Love Story (#8, 71 days) surrounding international hits. The data confirms that when Nollywood content is available on the platform, it outperforms most global offerings, proving sustained audience loyalty to local storytelling despite the platform’s reduced investment.

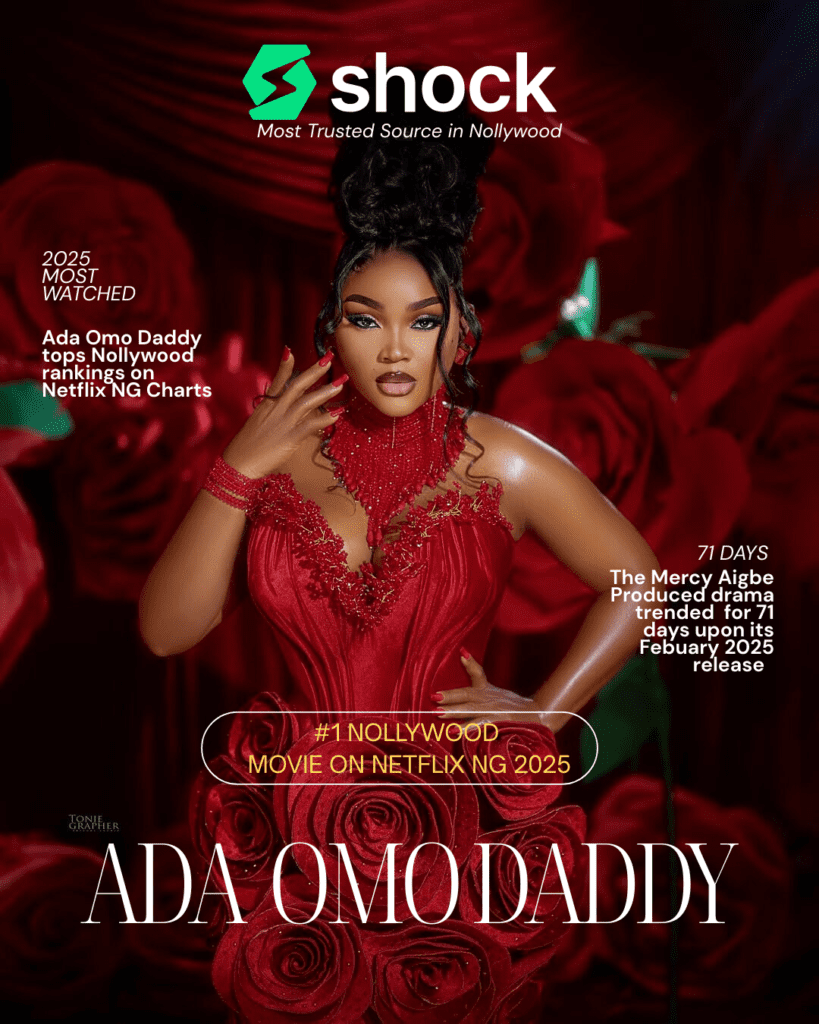

Theatrical-to-Streaming Success: Ada Omo Daddy’s Blueprint

Ada Omo Daddy’s #2 ranking with 71 days in the top 10 validates the theatrical-first release strategy now dominating Nollywood’s business model. The film’s cinema run built awareness and cultural conversation that translated directly into streaming viewership once it hit Netflix. This mirrors the pattern across Nigeria’s box office, where theatrical releases create premium positioning that extends content lifespan across multiple windows. For producers and investors, Ada Omo Daddy demonstrates that theatrical isn’t competing with streaming—it’s enhancing streaming value by establishing films as cultural events before they reach digital platforms.

Lisabi Sequel Underperforms Expectations

Lisabi: A Legend Is Born (#14, 32 days) represents a significant drop from the first installment’s 2024 dominance on Netflix Nigeria, where it ranked as one of the year’s most-watched titles. The sequel’s mid-tier performance at #14 suggests either audience fatigue with the franchise, marketing challenges, or that the first film satisfied viewer curiosity about the Yoruba resistance hero’s story. This decline is particularly notable given that sequels typically benefit from established audience bases. For the industry, it’s a cautionary tale about sequel timing, narrative continuation, and the risks of assuming automatic audience carryover—even for successful franchises in Nigeria’s hit-driven market.

The Forge: Christian Content’s Streaming Viability

The Forge (#26, 31 days) stands as the only faith-based title in the top 30, demonstrating niche but consistent demand for Christian content on Nigerian streaming platforms. While it doesn’t crack the upper tier, its 31-day run confirms that faith-based films have commercially viable audiences beyond church screenings and DVD sales. This represents an underserved market segment that smart producers could exploit, particularly given Nigeria’s significant Christian population and the success of faith-themed content in theatrical releases. The title’s presence suggests Netflix’s licensing strategy, however limited, recognizes diverse audience segments within the Nigerian market.

KPop Demon Hunters and Global Taste Convergence

The Korean animation’s 101-day reign at #1 signals Nigeria’s integration into global pop culture consumption patterns. This isn’t about Korean content displacing Nollywood—it’s about Nigerian audiences participating in the same cultural conversations as viewers in Seoul, Los Angeles, and São Paulo. The film’s sustained performance demonstrates that Nollywood doesn’t exist in isolation but competes within a global attention economy where quality genre content travels across borders.

For local producers, this presents both challenge and opportunity: Nigerian films must meet international production standards while maintaining cultural authenticity. The success of K-content in Nigeria also validates investment in genre filmmaking—horror, supernatural thrillers, and action—categories where Nollywood has historically underinvested despite clear audience appetite.

Genre Diversity Signals Market Maturation

Beyond the top performers, the genre spread across the top 30 reveals sophisticated audience preferences. Horror titles (Devil Is a Liar, Exterritorial, The Rats: A Witcher Tale) cluster in the top 15, while thrillers (Thinline, The Waiter) and period dramas (Lisabi, Farmer’s Bride) demonstrate appetite beyond romantic comedies.

This diversity should guide production decisions, particularly as the theatrical market gets tougher and streaming platforms rebalance their Nigerian content strategies. Investors eyeing Nollywood should note that audiences reward narrative ambition and genre experimentation when executed competently.

Read Full List: https://shockng.com/top-30-movies-on-netflix-nigeria-2025/

What This Means for 2026

Netflix Nigeria’s 2025 data confirms the industry’s post-streaming boom recalibration. Theatrical remains the premium release window, driving both box office revenue and downstream streaming value. Platform scarcity—Netflix’s 24 annual licenses versus hundreds of productions—makes securing distribution more competitive, rewarding producers who deliver commercially viable content that can compete globally. The presence of eight Nollywood titles in the top 10 proves audience demand hasn’t diminished; it’s the supply that’s constrained.

For filmmakers and investors, the strategy is clear: build for theatrical scale, ensure production quality meets international streaming standards, and recognize that platforms now serve as secondary monetization rather than primary destinations for premium Nigerian storytelling.

Thanks for Reading.

Shockng.com covers the big creators and players in the African film/TV industry and how they do business.

Let’s be friends on Instagram @Shockafrica